A body of work examines how Medicare beneficiaries respond to the many choices they have for comprehensive health and drug-only insurance. The unifying question is, are there too many choices, overwhelming beneficiaries' ability to make rational decisions? The answer to this question has implications for health coverage decision making among other populations, like those shopping on exchanges. Though, it should be noted that those populations differ from Medicare's. They're younger, healthier, and less cognitively impaired. Likewise, the shopping experience on exchanges may differ from that for Medicare plans, with differently designed interfaces (electronic or otherwise), support structures and programs, and other variations in availability of guidance. Nevertheless, experiments by Eric Johnson and colleagues indicate that consumers may have difficulty rationally selecting among exchange plans.

In a 2011 paper published in Health Affairs, Michael McWilliams and colleagues examined enrollment into Medicare Advantage (MA) plans as a function of number of plans available. They found that the probability of enrolling in an MA plan peaks when 30 plans are available, though it is very near the peak with only 15 plans. As the number of plans falls below 15 or rises above 30, the probability of enrolling falls off rapidly. (See this in chart form, here.) Why? A plausible explanation is that with fewer than 15 plans, beneficiaries have a harder time finding a plan that suits their needs. There isn't enough variety. With more than 30 plans, there is plenty of variety, but too much complexity. The challenge of comparing so many plans is paralyzing, and beneficiaries fall-back to the default of traditional Medicare. (Notably, there is no such obvious default in the new marketplaces that will arise under the Affordable Care Act). The authors wrote,

[M]ore choice may be detrimental if there are too many or overly complex options, particularly in high stakes decisions that involve health or money. Consumers may choose inferior options or make no choice as a result of cognitive overload, anticipated regret, or bias toward the status quo.

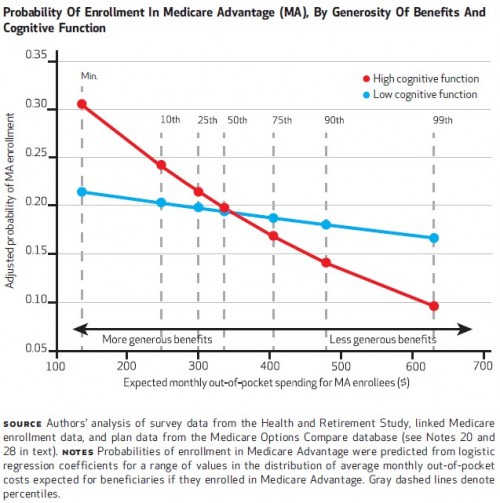

If this theory is correct, we ought to see different enrollment responses by cognitive function. Indeed, the authors found just that. The chart below illustrates probability of enrollment as a function of expected out-of-pocket cost. Beneficiaries with high cognitive function have a steeper response curve than those of low cognitive function, suggesting that the latter are less able to appreciate or recognize the value of benefits.

Indeed, according to a 2012 Kaiser Family Foundation survey, 40% of seniors responded that the degree of multiplicity of plans was confusing and made it difficult to select the best plan. In a paper published in Health Affairs last year, Chao Zhou and Yuting Zhang summarize similar evidence for Medicare Part D.

Jason Abaluck and Jonathan Gruber [ungated working paper version here] observed that Part D enrollees had difficulty making their initial plan choices when Part D started in 2006. They found that beneficiaries paid more attention to plan premiums than to their own total out-of-pocket health expenses. Florian Heiss and colleagues, using 2007 and 2008 Medicare Part D data to study plan choices, found that fewer than 10 percent of consumers enrolled in the least costly plans in 2007 and 2008 and that beneficiaries could save on average about $300 per year if they switched plans. [Hyperlinks added.]

Zhou and Zhang also found that only about 5% of beneficiaries chose the least expensive plan available in 2009, and seniors overspent by an average of $368 in that year. Interestingly, they also found that beneficiaries with cognitive difficulty chose cheaper plans, perhaps because such beneficiaries receive assistance from caregivers. In a recent follow-up to their earlier work, Jason Abaluck and Jonathan Gruber found that the suboptimality of choices by beneficiaries was persistent over time. However, in contrast, Jonathan Ketcham and colleagues (ungated working paper version here), found that after one year of experience with the program, beneficiaries did reduce their overspending.

Related to work of this type, one issue I wonder about is, what if beneficiaries did make optimal choices? What that would mean is those with high predicted spending would select more generous plans (making up in lower copays and deductibles what they lose in higher premiums) and those with low predicted spending would select less generous plans (making up in lower premiums what they lose in higher copays and deductibles). That would segment the market by risk, possibly inducing an adverse selection death spiral for more generous plans. Benjamin Handel found that improved decision making can exacerbate adverse selection at a large employer. (His paper is forthcoming in the American Economic Review, and summarized by me here.)

Suboptimal decision making has a risk pooling mechanism that promotes market stability. Nevertheless, better informed consumers can improve competition to the extent decision making is based on plan features that matter, as opposed to far less relevant heuristics like brand reputation. To the extent that better decisions do lead to problematic risk selection other interventions, like additional subsidization, could address the problem. Nevertheless, it is valuable to recognize that some degree of confusion can be harmful to consumers while playing a market stabilizing role.