It's conventional wisdom that the economic downturn played a role in reducing the rate of growth of health care spending. The mechanism, as it's often explained, is that unemployment went up, along with uninsurance rates, and income went down. With fewer resources to pay for care and more uncertainty about job stability, less care was purchased.

That's a demand-side story. But there was also a big and less widely recognized supply-side story associated with the economic downturn. Hospitals slowed their purchase of new stuff.

This shows up plainly in aggregate on the third page of this National Health Expenditures document (PDF). The line for "Structures and Equipment" shows that among the years 2000-2011 annual growth was negative in only two years: 2009 and 2010. Moreover, not only was annual growth in 2009 negative, it was very negative, -8.7%. Contrast that with growth in the 1990s, the era during which managed care exerted downward pressure on health spending. Then, hospitals spent an average of 9.4% in structures and equipment each year.

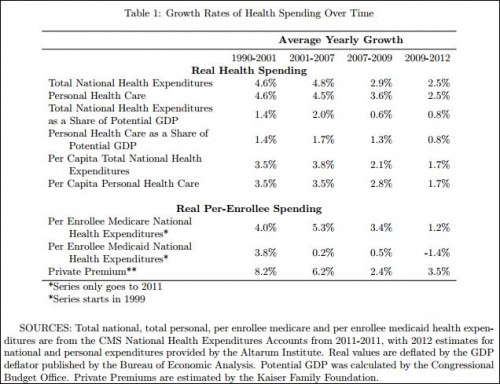

The recent, lower growth in spending on health care hardware also shows up in the work of Amitabh Chandra, Jonathan Holmes, and Jonathan Skinner. They document that personal health care spending, which excludes spending on structures and equipment, and total health care spending, which includes such spending, normally grow at nearly the same rate. (See the chart below.) However, during the recent recession (2007-2009) personal health care spending grew more rapidly than total health care spending. As shown in the first two rows of in the chart below, in 2007-2009, total national health expenditures grew 0.7 percentage points more slowly than did personal health care spending (2.9% vs 3.6%).

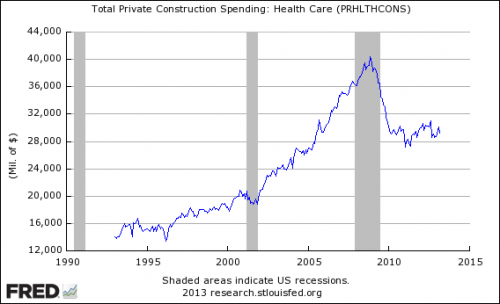

Finally, that the health sector slowed its buying of stuff also shows up in the time series of total private construction spending in the health care sector. As the chart below shows, the recent recession and subsequent slow recovery knocked out almost five years of growth in construction spending in health care. No, we can't prove causality with this chart, but you can see a similar, smaller effect during the prior recession too, which gives us a bit more confidence that this is not a coincidental relationship.

Finally, that the health sector slowed its buying of stuff also shows up in the time series of total private construction spending in the health care sector. As the chart below shows, the recent recession and subsequent slow recovery knocked out almost five years of growth in construction spending in health care. No, we can't prove causality with this chart, but you can see a similar, smaller effect during the prior recession too, which gives us a bit more confidence that this is not a coincidental relationship.

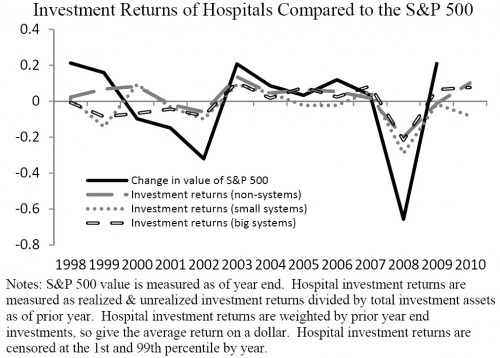

Indeed, there are good reasons hospitals are less likely to build new buildings and buy new medical machines during an economic downturn. For one, their returns on investment are depressed. This is documented in a recent paper by David Dranove, Craig Garthwaite, Christopher Ody, from which I took the following chart. With fewer resources, hospitals must cut back somewhere.

Indeed, there are good reasons hospitals are less likely to build new buildings and buy new medical machines during an economic downturn. For one, their returns on investment are depressed. This is documented in a recent paper by David Dranove, Craig Garthwaite, Christopher Ody, from which I took the following chart. With fewer resources, hospitals must cut back somewhere.

Another reason the health sector couldn't make as many big purchases during the economic downturn is that it may have lacked as ready access to credit during the credit crunch that kicked off the recession. If you have to offer higher interest rates on bonds, financing new construction and purchases will be that much harder.

Of course, we don't want to rely on recessions to bend the health care cost curve. Instead, we want the economy to grow and we want the health sector to make only efficient investments. We may (or may not) be on the long road toward that end, but we can certainly say we're not there yet.

--Austin

Another reason the health sector couldn't make as many big purchases during the economic downturn is that it may have lacked as ready access to credit during the credit crunch that kicked off the recession. If you have to offer higher interest rates on bonds, financing new construction and purchases will be that much harder.

Of course, we don't want to rely on recessions to bend the health care cost curve. Instead, we want the economy to grow and we want the health sector to make only efficient investments. We may (or may not) be on the long road toward that end, but we can certainly say we're not there yet.

--Austin