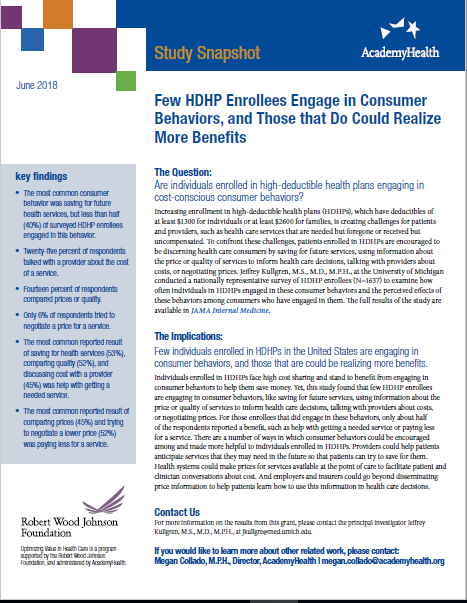

Few HDHP Enrollees Engage in Consumer Behaviors, and Those that Do Could Realize More Benefits

This study snapshot outlines findings from Robert Wood Johnson Foundation-funded research examining how often individuals in high deductible health plans (HDHPs) engaged in consumer behaviors and the perceived effects of these behaviors among consumers who have engaged in them.

Increasing enrollment in high-deductible health plans (HDHPs) is creating challenges for patients and providers, such as health care services that are needed but foregone or received but uncompensated. To confront these challenges, patients enrolled in HDHPs are encouraged to be discerning health care consumers, but this study found that few HDHP enrollees are engaging in consumer behaviors, like saving for future services, using information about the price or quality of services to inform health care decisions, talking with providers about costs, or negotiating prices.

This study snapshot outlines research by Jeffrey Kullgren, M.S., M.D., M.P.H., at the University of Michigan, who conducted a nationally representative survey of HDHP enrollees (N=1637) to examine how often individuals in HDHPs engaged in these consumer behaviors and the perceived effects of these behaviors among consumers who have engaged in them.

The full results of the study are available in JAMA Internal Medicine.

This project is funded as part of the Robert Wood Johnson Foundation’s solicitation “Optimizing Value in Health Care: Consumer-focused Trends from the Field,” which is managed by AcademyHealth.